The major reason that there is no income limit to apply for financial aid is because financial aid is very complex. Who qualifies for financial aid.

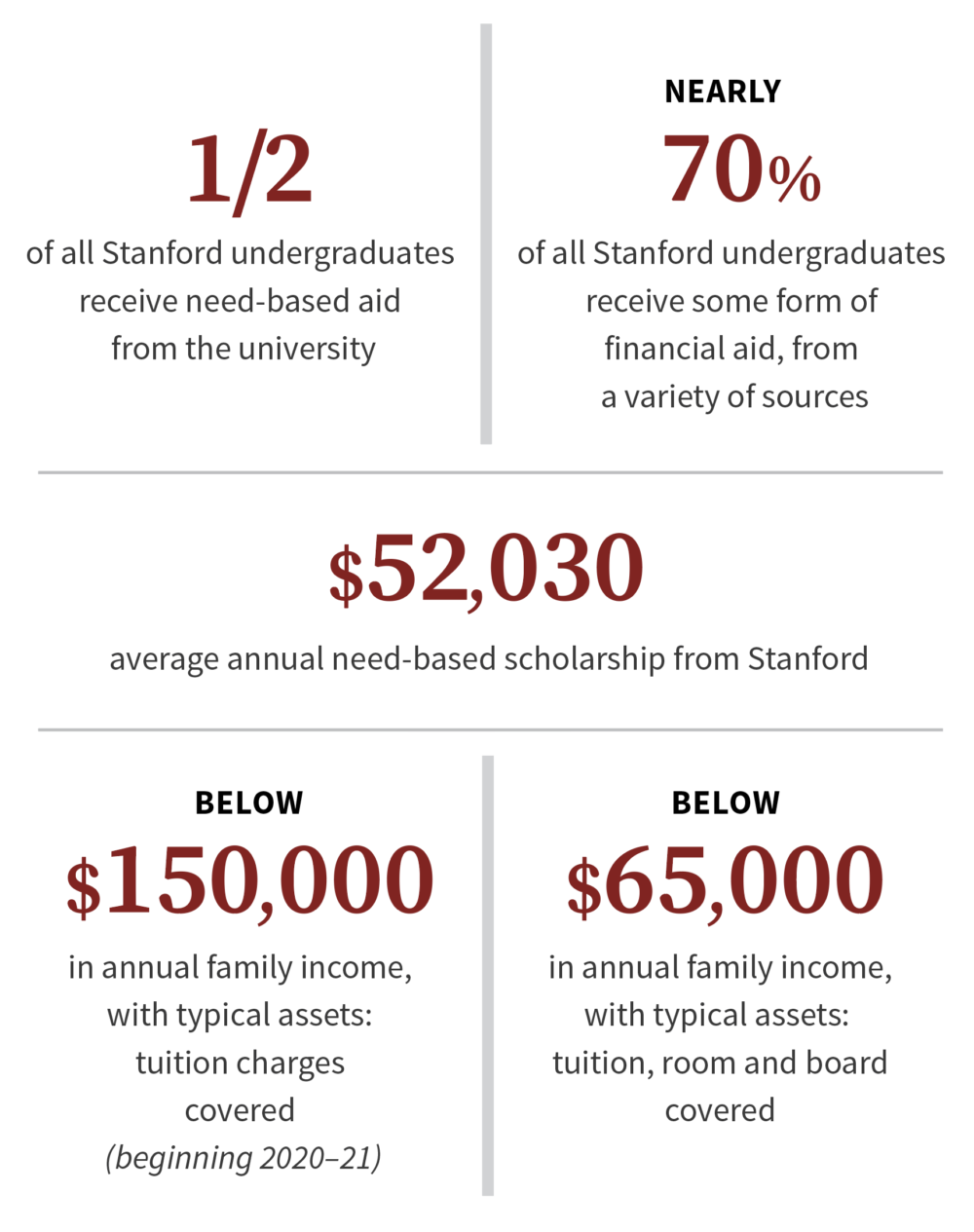

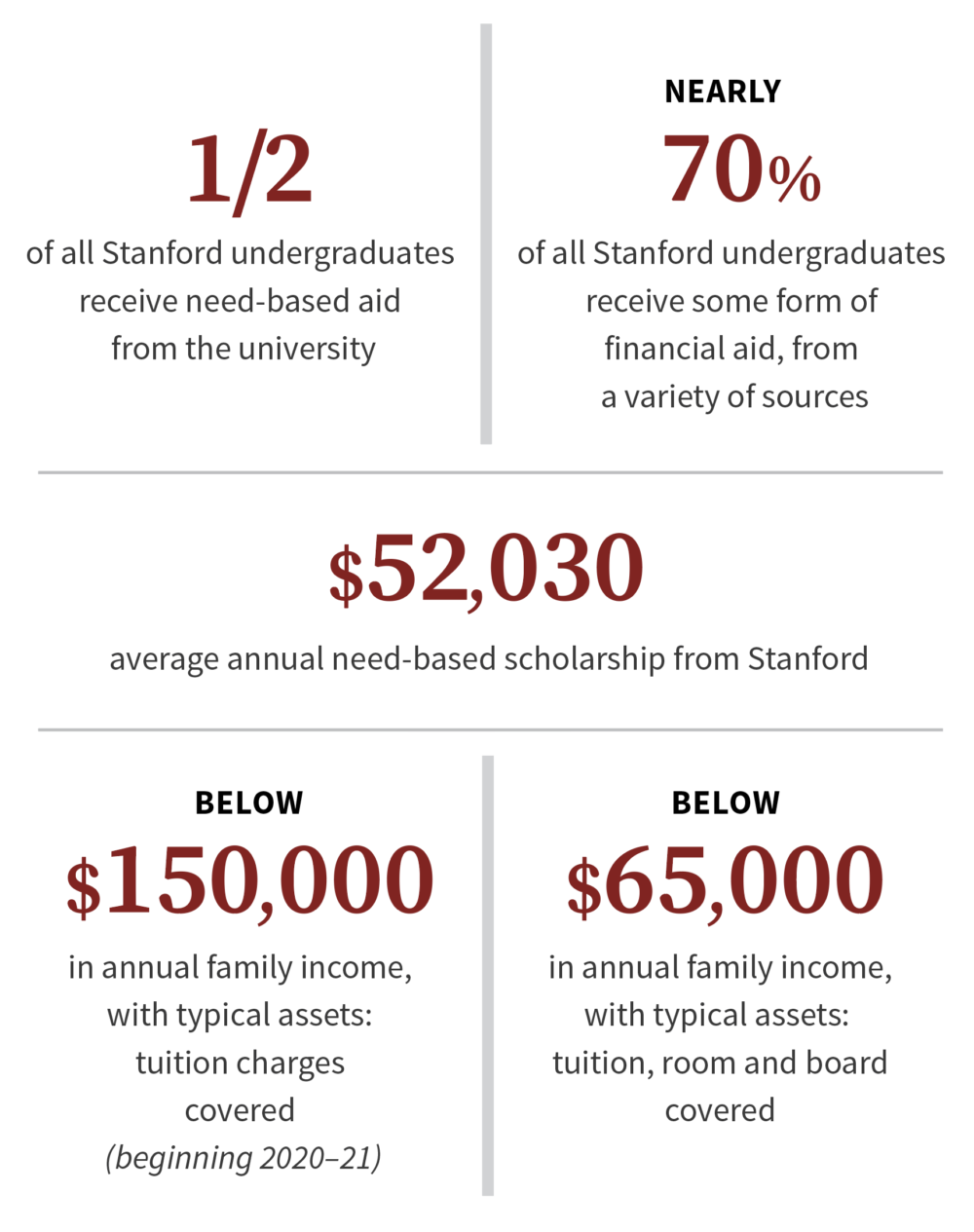

Trustees Set 2020 21 Tuition Again Expand Financial Aid For Middle Income Families Stanford News

Trustees Set 2020 21 Tuition Again Expand Financial Aid For Middle Income Families Stanford News

This is calculated by taking your expected family contribution EFC subtracting the cost of attendance COA at your chosen school and looking at the difference.

Financial aid cut off income. There is no income cutoff for financial aid awards. My parents make too much money so I wont qualify for aid Reality. The parent contribution is calculated by the Financial Aid Office based on the income and assets held by the family.

85 x 11. Still though- if you are paying low interest on your mortgage with income of 150-200K pretty big discrepancy- 50000 you should have plenty to live on and still be able to afford college. If two or more students from the same family are in college at the same time it greatly increases the chances that the family will qualify for financial aid.

There is no income cut-off to qualify for federal student aid. Families with a total annual income of 60000 or less and typical assets will have an expected parent contribution of 0. In order to qualify for full Pell a family would need to have a 0 EFC.

What is the Maximum Income to Qualify for Financial Aid. To get a Pell Grant you will need to fill out your Free Application for Federal Student Aid FAFSA and qualify for financial aid. Will your income throw your child out of the running for college aid.

I would expect that depending on number of dependents and cost of school a student coming from a family who makes 150000. If the students income is lower than it was two years agoor will be reduced once the student starts school and needs to work fewer hourshe or she should contact the schools financial aid office as soon as possible. The plan is billed in five monthly installments per semester.

Handout for the period of April 1 2020 to March 31 2021. It depends on a variety of factors and believe it or not there is no maximum income cutoff for financial aid. There is no specific income limit for a Pell Grant but you will need to demonstrate financial need.

Ideally the student should contact the school before filling out the FAFSA form but that isnt a requirement for the process The school might ask for proof of the change in income and may use. Student aid visit. That means that you can expect to receive a different financial.

Financial eligibility for Legal Aid Ontario. With the USC Payment Plan which enables students to establish an interest-free line of credit for tuition fees university housing and other student expenses. The financial threshold for a single applicant without dependents is increasing from the current 16728 in gross annual income to 17731 in.

Free Application for Federal Student Aid. Financial aid administrators use a needs analysis formula and this formula takes into account the expected family contribution. The application fee is 50.

One of the main influencers in determining aid eligibility is multiple children from the same family in college. As told above the amount of federal grant depends on family income and a few other factors. Many factorssuch as the size of your family and your year in schoolare taken into account.

So if the assets are 100000 then 50000 of the assets would be above the threshold and subject to the 564 percent reduction of 2820. Thats also the case if one of. Some families with over 200000 in annual income receive need-based aid from Yale.

College aid formulas expect parents to contribute up to 47 of their after-tax income to college costs each year. Every college will calculate financial aid according to their own unique formula. For more information visit the Student Financial Services website.

When you fill out the. The table below shows median financial aid awards for families of first-year students in the Class of 2023 who applied for aid. Situations can change- FAFSA may be required for merit aid- and you will want that to already be on file.

FAFSA is an application that is used to determine eligibility for federal aid. 200000 is WAY above the cutoff for federal grants. A certificate guarantees that a lawyer will be paid for representing a legal aid client for a certain number of hours.

The formula uses a bracketed system with a top bracket of 564 percent for any assets above the 50000 threshold. Information about the eligibility threshold for LAO certificate services duty counsel and summary legal advice services. Duke expects a minimum contribution from a first-year student of 2600 per year regardless of income.

If parents have a single child and their income is below 350000 a year there is a good chance that their kids will get qualified for this given they have filled out the FAFSA application.

If you have a low income and need help with basic living expenses you may qualify for government benefits to help cover food housing medical and other costs. What living expenses will FAFSA cover.

Financial Aid Budget Living Expenses Fall Term Spring

The amount of funding given to help pay for expenses such as tuition school supplies and living expenses is determined by numerous factors such as family income tuition program length and.

Financial aid for living expenses. Financial help from the donors or recipients workplace. Prepare debt management materials. The biggest expense for seniors is housing.

If you indicated that you will be living off campus paying rent during any quarter of the 2020 -2021. Financial aid is not only available to those enrolled in Australian universities and colleges. UC Berkeley Associate Vice Chancellor for Admissions and Enrollment answers financial aid questions about living expenses and off-campus housing.

Student Name Email. Your state helps pay for some of these and may offer others too. The budgets should not be confused with the actual boarding expenses experienced by an on-campus.

Any money that is left over after paying your tuition will be refunded back. Financial Aid Office Montag Hall 355 Galvez Street Stanford. Indirect costs are simply estimates used by our office in the awarding process to ensure that you have enough aid while direct costs are the actual amounts that will be charged to your myWSU account.

Generally your school receives your financial aid funds and allocates that money directly to your tuition or bill. Students who qualify for financial aid will be given a variety of grants scholarships and student loans to help cover living expenses in Australia. Prepare debt management materials.

A Comprehensive Guide to Financial Assistance for Senior Care and Living Expenses Senior Living Options. If you qualify for a federally-backed student loan you can use your financial aid disbursement surplus to pay for your miscellaneous living expenses. There are grants available for individuals families and businesses.

Using Your Financial Aid Surplus. Travel refunds If your recipient has insurance through their job check whether this insurance has any travel benefits for living donors. The first place most people look for financial support for seniors is via a.

These budgets are provided to assist financial aid officers in developing living expense budgets for their independent off-campus students. These budgets are provided to assist financial aid officers in developing living expense budgets for their independent off-campus students. Develop expense budgets for your independent commuting students.

CA 94305-6106 httpsfinancialaidstanfordedu FINANCIAL AID. Living Expenses for 2020-2021. It is important to differentiate between the two.

In most cases your disbursement will be forwarded directly to your schools financial aid office where the amount of your tuition will be taken out. Develop expense budgets for your independent commuting students. Benefits like these usually pay you back after the trip happens and send the refund check to the recipient.

Once this process is complete you can ask your financial aid. Major Government Benefits Programs. The federal government creates and gives money to states to run major assistance programs.

In addition to having a place to live most seniors. The budgets should not be confused with the actual boarding expenses experienced by an on-campus student. If youre enrolled full time you can use your financial aid award to help pay for living expenses including room board meal plans utilities and school supplies.

Sometimes programs at your work or your recipients work can also help with costs. Indirect costs are things such as living expenses transportation miscellaneous expenses etc.

Halaman

Real Estate School

Cari Blog Ini

Label

- 1400

- 1800s

- 1930

- 1940s

- 2014

- aapc

- abbreviate

- about

- accent

- accept

- acceptance

- accepted

- account

- accredited

- acknowledgement

- action

- activities

- adaptation

- adapting

- adding

- address

- adjective

- admission

- adults

- adverbs

- aesops

- affirmative

- africa

- after

- aggregate

- american

- analysis

- anatomy

- ancient

- android

- anesthesiologist

- apartment

- apartments

- apostles

- apostrophes

- application

- apply

- approach

- approve

- arabic

- architecture

- ardms

- argument

- argumentative

- aristotle

- around

- arrive

- arrowheads

- article

- artifacts

- artist

- arts

- assessment

- assistant

- associate

- associates

- association

- asterisks

- atlanta

- attendant

- audio

- aztecs

- bachelors

- back

- bank

- barrier

- barriers

- based

- basketball

- beads

- beautiful

- beauty

- because

- become

- becoming

- begin

- beginners

- bella

- bello

- benefits

- best

- better

- between

- bible

- biologist

- birthday

- blends

- board

- body

- book

- bottom

- bring

- british

- brush

- bubble

- building

- bullet

- business

- calculate

- calculator

- calculus

- called

- card

- caribbean

- carolina

- carpenter

- cash

- catalog

- cbest

- challenge

- change

- characteristics

- cheaper

- check

- cheerleading

- child

- children

- chinook

- christians

- ciao

- cite

- city

- civil

- civilizations

- class

- classes

- classical

- classmates

- classroom

- clep

- closing

- clothes

- coach

- coefficient

- collapse

- collection

- college

- colleges

- colonial

- colonists

- colosseum

- come

- comma

- common

- compass

- complete

- comprehension

- comptia

- computer

- concept

- conclusion

- concrete

- congressman

- cons

- considered

- consist

- contents

- contractions

- contributions

- converter

- cornerstone

- correct

- correlation

- cosmetology

- cost

- council

- countries

- country

- counts

- course

- courses

- cowboys

- create

- credibility

- credit

- credits

- criterion

- critical

- critique

- culinary

- cultural

- culture

- cuny

- curriculum

- curve

- date

- dates

- deactivate

- debate

- declaration

- define

- definition

- degree

- degrees

- delete

- deliver

- delivery

- delta

- dependents

- dermatologist

- dermatology

- descriptive

- design

- designing

- desires

- develop

- devices

- diagnostic

- diagram

- dialouge

- dibels

- difference

- differences

- different

- digraphs

- diploma

- direct

- disabled

- disbursed

- disciples

- disobedience

- distance

- doctor

- doctoral

- doctorate

- does

- doing

- donate

- dont

- dorms

- double

- down

- draw

- dress

- drinks

- drugs

- during

- dyslexia

- eagle

- earn

- easiest

- easy

- ecological

- economics

- edges

- education

- effectively

- effects

- election

- elementary

- elements

- embassy

- ending

- endow

- endowed

- engg

- england

- english

- enlist

- enroll

- enterprise

- envelope

- errors

- essay

- essentials

- establish

- estate

- ethical

- evaluate

- exam

- examiner

- example

- examples

- exercises

- expenses

- explain

- fable

- factors

- factory

- facts

- failed

- failing

- family

- farsi

- fashion

- fast

- felony

- field

- figurative

- final

- financial

- find

- finding

- first

- flight

- florida

- flow

- focus

- font

- food

- foods

- force

- foreign

- formal

- format

- foster

- framework

- fraternities

- free

- french

- freshman

- freshmen

- from

- full

- function

- functions

- funny

- games

- general

- geography

- gesell

- gift

- goals

- going

- good

- goods

- grade

- graders

- grades

- graduated

- graduating

- graduation

- grammar

- grant

- grants

- greece

- greek

- groups

- guide

- gunpowder

- gynecology

- happened

- happens

- harvard

- have

- hbcus

- heart

- hello

- help

- hexagon

- hierarchy

- higher

- highschool

- hobbes

- home

- homeless

- homeschooling

- honor

- honors

- hood

- hospitality

- hours

- houston

- humanities

- ideas

- identification

- identifier

- identify

- imperialism

- importance

- important

- inaugural

- income

- independence

- indian

- indians

- industrial

- infinitive

- influence

- Information

- intent

- interest

- interesting

- international

- intervene

- interviews

- into

- introduction

- introductions

- invented

- irish

- irony

- issues

- italian

- italicize

- italicized

- jesus

- jobs

- john

- join

- joint

- junior

- juris

- justice

- kappa

- kennedy

- kick

- kids

- king

- know

- lakota

- language

- languages

- lawyer

- league

- learn

- learned

- lebanese

- leed

- lessons

- letter

- letters

- level

- levels

- liberal

- life

- likelihood

- limitations

- list

- literal

- literature

- live

- loan

- loans

- logic

- login

- long

- longer

- longitude

- look

- looks

- love

- loyola

- made

- main

- major

- majors

- make

- makeup

- making

- many

- marine

- marines

- maryland

- masters

- mastery

- materials

- math

- mathematics

- mcat

- mean

- meaning

- means

- measurement

- mechanic

- mechanical

- medical

- member

- memorize

- memory

- mesopotamia

- mexico

- military

- minor

- minors

- miss

- missouri

- model

- modernism

- modification

- money

- most

- much

- multiple

- music

- name

- names

- narrative

- national

- native

- natural

- nature

- nclex

- need

- needed

- needs

- netflix

- neurologist

- nikes

- nominative

- north

- nostalgic

- notarized

- noun

- number

- nurse

- nurses

- nursing

- observation

- observations

- obstetrician

- obtain

- official

- online

- ordinate

- organization

- other

- outline

- over

- page

- paleo

- paper

- paragraph

- paramedic

- parents

- part

- parties

- parts

- pass

- passing

- past

- pcat

- pediatrician

- pediatrition

- penn

- pentecostal

- peoples

- percent

- percentage

- percentages

- percentile

- performing

- person

- personality

- perspective

- pharmacology

- philippines

- phoenix

- photo

- phrases

- physical

- place

- placement

- plane

- plasma

- plastic

- play

- pledging

- plural

- plus

- point

- points

- politics

- poor

- portal

- portfolio

- portfolios

- postcard

- postcards

- poster

- practice

- predicate

- predicates

- prep

- prepaid

- prepare

- prerequisites

- preschool

- prescriptive

- presentation

- president

- pretty

- primary

- printable

- printables

- private

- probability

- problems

- professor

- proficiency

- profile

- programs

- project

- pronoun

- pronunciation

- proper

- proposal

- pros

- protest

- psychology

- punctuate

- punctuation

- purpose

- qualifies

- qualitative

- quantitative

- quarter

- questions

- quote

- raleigh

- rank

- rating

- read

- reading

- real

- realia

- realtor

- reasons

- recommendation

- referenced

- refund

- regents

- regular

- religion

- remember

- remove

- report

- reports

- republicans

- requirements

- reschedule

- research

- reset

- results

- resume

- retention

- return

- review

- reviews

- revolution

- ride

- rome

- root

- ropes

- rosary

- rotc

- salary

- sales

- salutation

- salutatorian

- same

- sample

- scale

- scales

- scholarship

- scholarships

- schools

- science

- sciences

- score

- scores

- second

- self

- semester

- send

- senior

- sentence

- service

- short

- show

- side

- sigma

- sign

- signal

- sing

- singular

- sioux

- skip

- skipped

- slang

- smallest

- smart

- soap

- social

- society

- sociology

- socrates

- software

- some

- something

- song

- sorority

- sound

- southern

- spanish

- speak

- speaker

- special

- speech

- speeches

- speed

- spell

- spelling

- spirit

- splitting

- sports

- stages

- stamps

- stand

- standard

- standardized

- stanford

- start

- state

- statement

- stole

- stoles

- story

- strengths

- student

- studies

- study

- style

- styles

- subject

- subjects

- subliminal

- suffixes

- suitcases

- summarize

- summer

- supper

- surgeon

- surgeons

- surgical

- system

- tabe

- table

- tacky

- take

- takes

- taks

- talent

- tassel

- teachers

- teaching

- teams

- technical

- technician

- teenagers

- teens

- template

- tense

- terminology

- test

- texas

- than

- thank

- that

- their

- thematic

- theories

- thesis

- theta

- they

- three

- throughout

- thunder

- time

- tips

- title

- tools

- topics

- toronto

- trade

- training

- traits

- transcript

- transcripts

- transition

- transitions

- translate

- translation

- tribe

- troubled

- tuition

- twelve

- types

- typing

- ultrasound

- uniforms

- universal

- universities

- university

- unweighted

- used

- uses

- usps

- valedictorian

- validate

- verbs

- verizon

- versus

- vertebrate

- very

- veterans

- videos

- view

- visual

- vivid

- vocational

- volunteer

- vowel

- wacky

- warrant

- ways

- weakness

- weaknesses

- wear

- website

- wedding

- week

- weighted

- were

- west

- what

- whats

- when

- where

- with

- without

- womens

- wood

- word

- work

- works

- world

- worship

- write

- writing

- year

- yearbook

- years

- york

- your

- youre

- zero